What Makes a Good Insurance Agent and How to Find One

Like finding a good doctor or dentist, getting an effective insurance agent can impact your quality of life. Think about it: Your trusted insurance...

Discover insurance options that are as unique as you are.

Get or retrieve a quote, find an agent, and more.

Report a claim or find a repair shop.

Learn about Kemper, our products and services, find information for investors, job-seekers, and users with disabilities, and more.

Independent insurance agents are guides to help customers find the type of coverage that suits their unique needs. Unlike agents tied to a single company, independent agents have the flexibility to explore a variety of options from different providers. Let's dive into why choosing an independent agent could be the optimal decision for securing your insurance needs.

Independent agents don't believe in one-size-fits-all solutions. They're dedicated advisors who take the time to understand your specific requirements. They engage in meaningful conversations to understand not only your current auto situation but also future plans.

By learning about your lifestyle, preferences and potential risks, independent agents can provide personalized guidance that ensures your insurance solutions align with your unique circumstances. This approach allows independent agents to anticipate potential risks customers may face.

Whether you're a young professional, a growing family, or enjoying retirement, an independent agent ensures your coverage works for you.

.jpg?width=600&height=290&name=Design_%204%20Reasons%20to%20Choose%20an%20Independent%20Insurance%20Agent%20(1).jpg)

One of the advantages of independent agents is their ability to offer a range of policies.

While some agents are attached to a single company's offerings, independent agents have the freedom to search the market. They navigate through policies from various insurers to present you with an extensive menu of options.

Having variety allows you to make an informed decision based on your preferences and budget. Whether you prioritize comprehensive coverage, specific policy features or cost-effectiveness, the freedom to choose from several options ensures that your coverage best aligns with you.

Independent agents are almost like your financial advocates. They will do the hard work for you by browsing policies, comparing prices and evaluating coverages.

Part of an independent agent’s job is to find you a policy that best balances between cost and benefits, ensuring you receive the best value for your hard-earned money. This thorough evaluation of policy options means you can trust that your independent agent is working diligently to secure coverage that meets your needs without unnecessary financial strain.

In a market filled with nuances, having an independent agent advocating for your financial interests can make a considerable difference in the overall cost-effectiveness of your insurance.

Choosing an independent agent is not just a one-time transaction, it's a commitment to ongoing support.

Your independent agent remains by your side throughout your entire insurance journey. From the initial policy selection to renewal time, they serve as your dedicated insurance ally. Additionally, they proactively review your coverage over time, ensuring that your policy remains aligned with any changes in your life. Independent agents also serve as your advocate in dealing with insurance companies, making sure your concerns are addressed promptly and professionally.

This continuous support establishes a relationship built on trust and reliability, making the complex world of insurance more manageable and less daunting with an ally that has your back.

In conclusion, independent insurance agents are partners in your financial well-being. The personalized guidance, wide choice of options, value for your money, and ongoing support they offer make them invaluable allies in navigating the insurance landscape.

Consider the advantages of an independent agent who prioritizes your needs and provides a comprehensive approach to safeguarding not just your vehicle but your future.

Kemper works with some of the best independent agents in the business. Find an agent near you!

This material is for general informational purposes only. Products, services, and discounts referenced herein are not available in all states or all underwriting companies. All statements are subject to the terms, exclusions and conditions of the applicable policy. In all instances, current policy contract language prevails. Coverage is subject to individual policyholders meeting our underwriting qualifications and state availability. Other terms, conditions and exclusions may apply.

Like finding a good doctor or dentist, getting an effective insurance agent can impact your quality of life. Think about it: Your trusted insurance...

Whether you commute to work in Oregon or take a road trip to see its diverse landscape, having affordable car insurance is a priority for many...

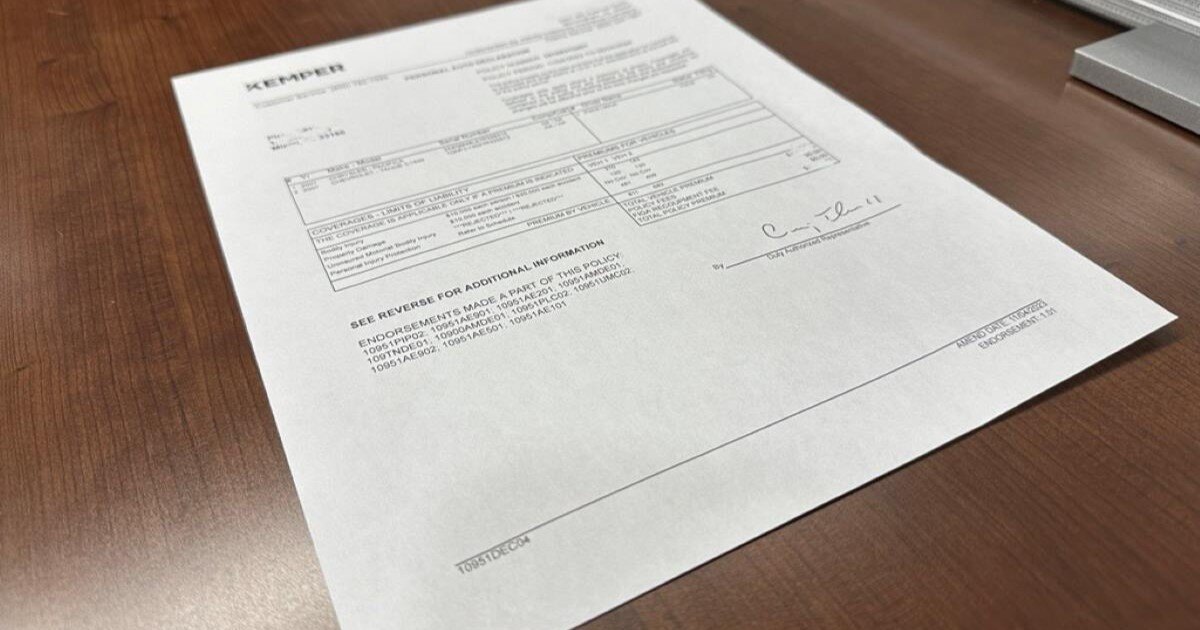

What is a declaration page in insurance? A declaration page or “dec page” is a summary of your auto insurance policy with important information about...