4 Reasons to Choose an Independent Insurance Agent

What is an independent insurance agent? Independent insurance agents are guides to help customers find the type of coverage that suits their unique...

Discover insurance options that are as unique as you are.

Get or retrieve a quote, find an agent, and more.

Report a claim or find a repair shop.

Learn about Kemper, our products and services, find information for investors, job-seekers, and users with disabilities, and more.

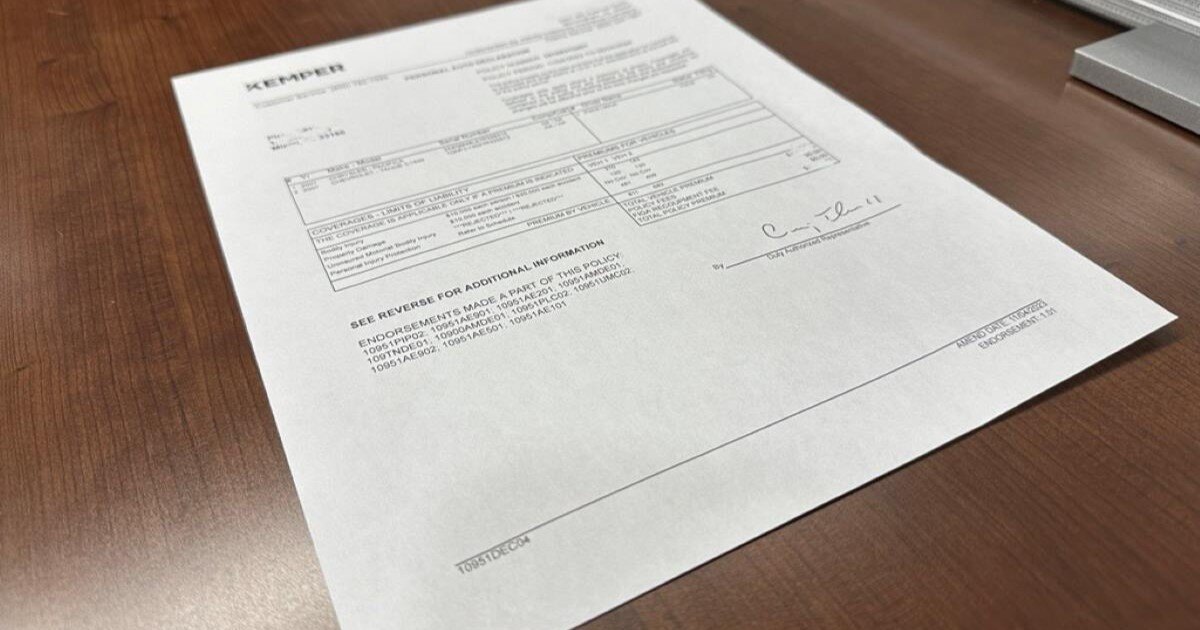

A declaration page or “dec page” is a summary of your auto insurance policy with important information about your insurance coverage. The declaration page provides specific information you (the insured) would need when asking questions or reporting a claim to your insurance company.

To help you read your declaration page, we have put together a guide to assist in navigating your policy.

Although each company organizes its declaration page differently, all the items listed above are the basic information that should be on your page.

If you have questions about what address is on file with the insurer, who is covered under the policy, what coverage you selected, which vehicles are covered, or simply want to know your policy number—all you have to do is refer to the declaration page.

Understanding your declarations page is important to know the extent of your coverage and premiums in the case of an accident. By reviewing this guide, you can learn more in-depth details about your policy.

This material is for general informational purposes only. Products, services, and discounts referenced herein are not available in all states or all underwriting companies. All statements are subject to the terms, exclusions and conditions of the applicable policy. In all instances, current policy contract language prevails. Coverage is subject to individual policyholders meeting our underwriting qualifications and state availability. Other terms, conditions and exclusions may apply.

What is an independent insurance agent? Independent insurance agents are guides to help customers find the type of coverage that suits their unique...

Like finding a good doctor or dentist, getting an effective insurance agent can impact your quality of life. Think about it: Your trusted insurance...

Whether you commute to work in Oregon or take a road trip to see its diverse landscape, having affordable car insurance is a priority for many...